Making a small business profit is not the same thing as having cash on hand – or your business cash flow. My advice for small business owners: Cash is king! Cash is what enables a business to pay its owner’s salary.

Take control of your business finances

Understand and manage your business cash flow with these 5 critical learning points:

1 – Understand the difference between profit and cash flow

Your business profit is the difference between your revenues and your expenses. Revenues are recorded when you bill your customers, not necessarily when you get paid. You can have a good profit but no cash. This is often because your customer accounts receivable increased or because you reinvested in your business using your cash.

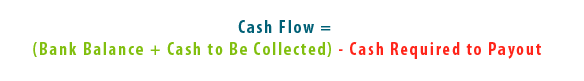

Your cash flow is determined by your current bank balance plus what cash you will collect less what cash you are required to payout.

2 – Know your working capital

It is also important for small business owners to know how to calculate “working capital” instead of just looking at a bank balance as a gauge of performance. The quick way to calculate working capital is to add your accounts receivable and your inventory to your bank account then minus your accounts payable and minus your line of credit balance.

Once you know your current working capital balance you can calculate it at different times to determine if you are winning or losing the small business success game.

3 – Finance capital investments with loans, not your line of credit

Your bank line of credit is part of your working capital. This is usually the hardest type of business financing to get so it should be preserved as much as possible. In order to maintain or grow your working capital it is important not to use your line of credit for capital investments that can be financed by term type loans. For example, instead of writing a check on your line of credit for a new piece of equipment, arrange a bank term loan or use the existing financing that may be available from the vendor.

4 – Invoice at the transaction

Some goods ways to improve your business cash flow are to issue your invoices right at the time of the purchase or service delivery. Customers start to forget about the experience soon after the sale, which also decreases the chance of prompt payment. It is also very important to negotiate the specific timing of payment prior to the sale. This is when you have the most leverage. Customers who are asked and agree to the credit terms up front are most likely to stick to the payment terms.

5 – Stay on top of upcoming cash expenditures

You may also manage your cash flow by preparing a weekly “cash requirements report” either manually or using a simple electronic worksheet. Just list the expenditures down the left side and fill in an estimate of the expense if you don’t know the actual amount. Things like your payroll and government remittances are usually easy to estimate. Once you know the expected expenditures for the week you now know your collections target after deducting your cash on hand or available line of credit. It is useful to prepare this for the upcoming 4 or 5 weeks.

Avoid a cash flow crisis

by successfully managing your cash flow.

If you know where your cash stands, you can get business financial help by anticipating cash flow challenges in the future. Discuss them proactively with your banker. Most lenders still want to loan you money because it’s how they earn their income. What really makes them nervous is when you call up asking them to increase the line this afternoon to make payroll! This communicates to a bank that you aren’t planning well, or you’re getting into trouble. If you are proactive with your lender in preparing for cash challenges it will allow you more time to focus on making money and less time wasted managing a cash crisis.

When you have sufficient cash for the short term you can make better strategic decisions for the long term future of your business… and your stress will go down too.